The total cost of production in the short run. Production costs - Economic theory (Vassilieva E.V.). Production costs in the long run: economies of scale

The basis of any economic decision should contain the answer to the question of the correlation of what is spent on a particular project and what can be obtained from its implementation in addition to the costs incurred. This result is determined by profit.

Before making a decision on how much to produce products or products, the company must conduct a cost analysis. Costs in general form are the payment for the acquired factors of production.

Costs are divided into two main groups. Explicit costs include cash payments for factors of production to suppliers. They are fully reflected in the accounting of the company, so they are sometimes called accounting costs. Implicit costs include the opportunity cost of using resources that are owned by the enterprise.

The sum of explicit and implicit costs are economic costs. Not all costs incurred by an organization need to be included in accounting costs. This is due to the fact that a certain share of the costs is carried out by the company at the expense of profits. Examples would be income tax, a premium that is paid by a company out of profits, material aid workers and others.

The opportunity cost of production can be measured in terms of the greatest lost opportunity cost that was used to create factors of production. Also, opportunity costs act as the difference in profits that could be obtained with more efficient use resources and real profits.

Not all costs or costs can be attributed to opportunity costs. In the implementation of any method of using resources, the costs that the enterprise incurs without fail are not considered alternative. This may be renting premises, the cost of registering an enterprise. These costs are not alternative, they do not participate in the process of economic choice.

Fixed and variable costs in the short run

Fixed (TFC) production costs are the costs of using fixed factors of production. They do not depend on production volumes and are determined by the quantity and price of the permanent resources used.

Production costs in the short run are related to the very existence of the enterprise, paid for by it even when no product is produced at all. Permanent costs consist of depreciation charges for buildings and structures, equipment, salaries of management personnel, insurance premiums and rent payments.

Production costs in the short run also include variable costs (TVC). These are the costs incurred from the use of variable production factors. Their value depends on the volume of manufactured products, and as output increases, there is an increase in this type of cost. These include the cost of raw materials, electricity, wages main workers.

Average cost

If you add up the fixed and variable costs, then in total we get the total costs. Sometimes they are called gross, total or total costs. They are determined for the short term by the following formula

TC= TFC+ TVC

Production costs in the short run are able to characterize the overall level of production costs of the enterprise. Average production costs characterize the level of costs for each unit of production. You can also select the average constants (A.F.C.) and variable costs (AVC). By means of average fixed costs, the costs of fixed production resources are reflected, with the help of which a unit of products is produced. They can be determined through the ratio of fixed costs and production volume:

AFC=TFC/Q

By means of average variable costs, the costs of variable production resources are reflected, with the help of which a unit of products is produced. Their formula looks like this:

AVC=TVC/Q

Average and marginal costs in the short run

The average cost of production in the short run may reflect the costs of fixed and variable resources. Then we can talk about the average total cost of production, in accordance with which a unit of output is produced. Average total cost of production by the ratio of total costs to the volume of production:

ATC=TC/Q

Consider also the concept of marginal cost, which is the increase in the total cost associated with the release of an additional unit of products. Marginal production costs characterize the rate at which total variable costs increase with an increase in output.

Graphical interpretation of the company's costs in the short period.

Short term - this is a time interval insufficient for modernization or commissioning of new production capacity. However, during this period, the company can increase the volume of output by increasing the degree of intensity of the use of existing production capacities. It follows that in the short run costs can be either fixed (TFC) or variable (TVC). The sum of all fixed and variable costs is called total or total costs(TS).

The TVC curve shows how variable costs change as output increases. At first they increase at a low rate, then their growth accelerates. Such dynamics of TVC is explained by the law of diminishing returns of factors of production, according to which an increase in the marginal product at first requires less and less variable costs, since the marginal productivity of factors increases. But as soon as it starts to decline, more and more variable resources will be required to produce each subsequent unit of output.

The TS curve, which reflects the sum of fixed and variable costs, is located above the latter by an amount equal to fixed costs, i.e. it is parallel to the TVC curve. The TFC curve shows the dynamics of fixed costs, the value of which is unchanged at any level of production.

In addition to total costs, the entrepreneur is interested in average costs, the value of which is always indicated per unit of output. There are average total (ATC), average variable (AVC) and average fixed (AFC) costs.

Average total cost (ATC) is the total cost per unit of output that is commonly used to compare against price.

Average variable cost (AVC) - is a cost indicator variable factor per unit of production.

Average fixed costs (AFC) - indicator of fixed costs per unit of output.

|

Rice. 4.2. Relationship between average and marginal costs

As the volume of production increases average variable cost AVC first decrease, reach their minimum, and then begin to rise. Such dynamics of AVC is due to the operation of the law of diminishing returns of factors of production.

Average fixed costs(AFC) decrease as the amount is distributed over an increasing amount of output.

Average total (cumulative) costs(ATS) first decrease, and then begin to grow. This is because average fixed costs in the short run decrease as output increases. Therefore, the difference in the height of the ATC and AVC curves at a given volume of production depends on the value of AFC. This follows from the equality: ATC = AFC + AVC

marginal cost(MS) - the cost of producing an additional unit of output in excess of the quantity already produced. MC can be determined by dividing the change in total cost by the number of units of output that caused the change:

There is a certain relationship between marginal cost and marginal productivity (marginal product MP). As long as marginal product rises, marginal (average variable) costs will fall and vice versa. At the points of maximum value of marginal and average products, the value of marginal MC and average variable costs AVC will be minimal.

There is a relationship between MS, AVC and ATC. If MS<АVС уже произведенной единицы продукции, то AVC будут снижаться при производстве и следующей единицы. Если же МС >AVC, then AVC, respectively, will increase.

Producer win equals the total excess of the selling price over the marginal cost of production. Name manufacturer win

Gossen's laws.

Through these laws, Gossen described the rules for the rational behavior of a subject seeking to extract maximum utility from his economic activity.

The first question is what determines the value of utility? Gossen drew attention to the fact that utility depends not only on consumer properties good, but also from the process of its consumption. Meaning of Gossen's first law: 1. in one continuous act of consumption, the utility of the next unit of the consumed good decreases; 2. in the repeated act of consumption, the utility of each unit of the good decreases in comparison with its utility in the initial consumption.

Putting units of some good on the abscissa axis, and their utility on the ordinate axis, it is easy to construct an AC curve, which will express the decrease in utility during one act of consumption.

On this basis, Gossen concludes: "Single atoms of the same consumer good have very different values."

The significance of Gossen's first law for economic science is, firstly, that it allows one to distinguish overall utility some supply of a good and the marginal utility of that good.

Second, the postulate of diminishing marginal utility of a good is necessary condition achievement by an economic subject of a state of equilibrium, i.e. a state in which he extracts the maximum utility from the resources at his disposal.

The subject will be able to achieve a state of equilibrium if he is guided by Gossen's second law: to get the maximum utility from the consumption of a given set of goods for a limited period of time, you need to consume each of them in such quantities that the marginal utility of all consumed goods will be equal to the same value. If there is no such equality, then by redistributing the time allocated for the consumption of individual goods, one can increase overall utility.

Rice. 4. Decreasing marginal utility of labor.

Gossen considers labor as a special good, the utility of which varies in full accordance with the first law. But unlike ordinary goods, the marginal utility of labor can reach negative values. “Any movement,” writes Gossen, “after we have rested for a long time, gives us pleasure at first. With the continuation of its pleasure, this obeys the above law of falling. If, continuing, it has fallen to zero, then this not only stops pleasure, but the need to continue the expenditure of one's own strength gives a feeling that is the opposite of pleasure. On fig. 4 N 0 hours of work - "a joy", the further continuation of work - "a burden". When determining the optimal ratio between free and working time, Gossen recommends adhering to the following rule: “In order to achieve the greatest pleasure in life, a person must distribute his time and effort in achieving various kinds of pleasure in such a way that the value of the ultimate atom of each received pleasure would be equal to fatigue. , which he has undergone if he had reached this atom at the last moment of the expenditure of his energy.

The methodology used by Gossen in describing the behavior of economic entities entered economic science as a classic decision-making logic, on the basis of which the actions of market economy agents are explained.

Producer equilibrium

consumer balance.

Engel curves.

Giffen effect.

This rather rare phenomenon, when consumer demand for a product that has risen in price, was first noticed in the middle of the 20th century in Ireland: the population began to buy more potatoes that had risen in price. Giffen's product is low quality cheap goods, which occupies a large place in the consumer basket of low-income consumers. When prices rise, their budget suffers so much that consumers abandon their earlier purchases of more expensive substitutes, increasing consumption of the more expensive product, which, nevertheless, remains the cheapest alternative. Its relative rise in price is offset by a reduction in the purchasing power of consumers due to the increase in its price, forcing consumers to purchase the cheapest goods.

Since the productive consumption of available resources is carried out in the production process, there is a functional relationship between the volume of production and the amount of consumed production resources. It can be expressed with production function. If the entire set of production resources is represented as the costs of labor, capital and materials, then the production function has next view: Q=f(L´K´M), where Q is the maximum volume of products produced with a given technology and a given ratio of labor (L), capital (K) and materials (M).

The production function expresses the relationship between the factors of production and makes it possible to determine the share of participation of each of them in the creation of goods and services. By changing the ratio of factors, one can find such a combination of them that will achieve the maximum volume of production of goods and services. In addition, it is possible to trace how output changes with an increase or decrease in the use of certain factors of production by one unit and, thus, achieve an optimal combination of factors and identify the production capabilities of the enterprise.

Technology - this is the practical use of technology, equipment, physical and intellectual capabilities of the enterprise personnel. Each of the available production technologies corresponds to a number of specific combinations of factors used.

Isoquant (iso - the same, quant - quantity) is a curve, the points on which show different combinations of factors used, in which the same amount of output is produced. All of them together form an isoquant map, which gives a complete picture of the production methods used. Each of the isoquants, located to the right and above the base one, shows an increase in output. Isoquants can pass through any point on the graph.

Isoquant (iso - the same, quant - quantity) is a curve, the points on which show different combinations of factors used, in which the same amount of output is produced. All of them together form an isoquant map, which gives a complete picture of the production methods used. Each of the isoquants, located to the right and above the base one, shows an increase in output. Isoquants can pass through any point on the graph.

Isoquants reflect alternative combinations of inputs of factors for the production of a certain volume of output. Isoquants indicate the ability of the company to flexibly make production decisions, change the combination of resources used. However, there are also limitations here. One of them is the duration of the time interval within which a given production process takes place.

Short term called such a time period during which the company is not able to quantitatively change all its factors of production. In this case, some factors will be unchanged, fixed, others - changing, variable. A firm can influence the course and productivity of production in the short term only by changing the intensity of the use of its variable factors (production capacity, labor, raw materials, auxiliary materials, fuel) or changing their quantity.

Long term - such a time period during which the firm is able to change the amount of all factors used, including production capacity. At the same time, this period should be long enough for some firms to leave the industry, while others, on the contrary, to enter it.

Isoquant analysis can be used to determine the marginal rate of technological substitution, i.e. the possibility of substituting one resource for another in the course of their use.

Marginal rate of technological replacement(MPTS) expresses the number of units this resource, which can be replaced by a unit of another resource while maintaining the same output.

The marginal rate of technological substitution at any point of the isoquant is equal to the slope of the tangent at that point, multiplied by -1:

![]() , where DK - reduction or increase in the resource of capital; DL - reduction or increase in labor resource; Q is the volume of production.

, where DK - reduction or increase in the resource of capital; DL - reduction or increase in labor resource; Q is the volume of production.

The curvature of the isoquant helps the manager to determine exactly how much labor savings will be required during implementation. new technology production. The curvature of the isoquant reflects the difficulties that an enterprise has when replacing one factor with another in the face of the need to maintain a given volume of production.

Proposal and its law

Supply is the willingness and ability of a producer to sell a product on the market. The volume (value) of supply is the amount of goods or services that producers are willing to sell at a certain price for a certain period of time.

The law of supply expresses a direct relationship between the price and quantity of goods produced and offered for sale. If the price rises, then more goods will come to the market for sale and vice versa. In this case, the supply function has the form: QS = f (P), where QS is the supply value.

Qs = Qs(Pi , Pj...Pn, T,t, N...), where Pj...Pn are the prices of other goods and production resources, T is the characteristic of the applied technology, t is the tax rate, N is the characteristic natural and climatic conditions of production. Assuming other factors to be constant, we obtain the supply function of the price: Qs = Qs(Pi). This function usually given analytically (linear Qs = -a+bPi), or graphically - as a sentence line

The supply curve (S) is a set of points whose coordinates correspond to a certain price (P) and the characteristic value of the supply of goods (Q) (Fig. 4.1).

|

Rice. 4.1. Supply curve

A price change, ceteris paribus, moves a point on the available supply schedule, increasing or decreasing the supply. On fig. 4.1. as a result of an increase in price, the quantity supplied increases, which is indicated by a movement from point A to point B.

Supply Factors

The price determines the point on the supply schedule corresponding to its specific value. The very position of the curve on the graph depends on non-price supply factors.

A change in the quantity of a good that producers are willing and able to sell, resulting from a change in non-price factors, is called a change in supply. A change in supply is indicated by a shift in the supply curve to the right (S1) if supply is increasing, or to the left (S2) if supply is decreasing (Figure 4.2).

|

Rice. 4.2. Change of offer

The determinants of the proposal include:

1. Prices for applied resources.

If the prices of used resources increase, then, ceteris paribus, the supply will decrease and vice versa, if the prices of resources decrease, the supply increases.

2. Change in production technology.

Implementation new technology and technology leads to increased supply.

3. State economic policy.

Reducing tax rates increases market supply, and the increase, respectively, reduces. The reverse effect on the supply is exerted by state subsidies and subsidies.

4. Change in prices for goods produced from the same resources as this product. If prices for such goods rise, then producers will reorient production by reducing production. this product, starting the production of goods, the price of which is growing. Thus, the supply of the originally produced good decreases.

5. Price expectations of sellers.

If prices are expected to rise, today this leads to a decrease in supply. Conversely, an expected decrease in prices leads to an increase in the supply of goods at a given price.

6. Number of sellers. As the number of sellers in the market increases, the supply increases.

Utility and demand

The quantitative approach to utility analysis is based on the idea of the possibility of measuring various goods in hypothetical utility units ≈ utils (from English. utility ≈ utility).

In particular, it is assumed: the consumer can say that daily consumption of 1 apple brings him satisfaction, say, 20 utils, daily consumption of 2 apples ≈ 38 utils, daily consumption of 2 apples and 1 cigarette ≈ 50 utils, daily consumption of 2 apples, 1 cigarettes and 1 orange ≈ 63 units, etc.

It should be emphasized that quantitative assessments of the usefulness of a particular product or product set are exclusively individual, subjective. The quantitative approach does not imply the possibility of an objective measurement of the usefulness of a product in utils. The same product may be of great value to one consumer and of no value to another. In the example above, we are probably talking about a heavy smoker, since adding 1 cigarette to 2 apples significantly increased the usefulness of the product set. Quantitative approach usually also does not provide for the possibility of comparing the volume of satisfaction received by different consumers.

Economists have repeatedly tried to get rid of the term "utility", which has some evaluative character, to find a suitable replacement for it. Thus, the well-known Russian economist N. X. Bunge proposed using the term "suitability" (Nutze ≈ German.). "The need for narcotic substances," he wrote, "is undoubted, but is it possible to say that opium and hashish are useful for smokers, they are only suitable as a substance for intoxication." one

The Italian-Swiss economist and sociologist V. Pareto suggested replacing the term "utility" with the neologism ophelimite, which he formed from the Greek iojelimoz, meaning the correspondence between a thing and a desire. The French economist C. Gide suggested using the term "desirability" (desirabilite ≈ fr.), believing that he "does not presuppose in desire moral or immoral traits, reasonable or reckless." 2

The well-known American economist and statistician I. Fisher also spoke in support of the term "desirability". "Utility," he believed, "is the legacy of Bentham and his theory of pleasure and pain." 3 Fisher also pointed out the preference for the antonym "undesirability" over "uselessness". (The one used in our contemporary literature antonym "anti-utility").

Nevertheless, the term "utility" outlived its critics and is still used today.

So, in the quantitative theory of utility, it is assumed that the consumer can quantify in utils the utility of any bundle of goods he consumes. Formally, this can be written as a function general utility:

TU = F(Q A , Q B , ..., Q Z), (3.1)

where TU≈ the total utility of a given product set; Q A , Q B , ┘, Q Z≈ volumes of consumption of goods A, B, ..., Z per unit of time.

Great importance have assumptions about the nature of the general utility function.

We fix the volumes of consumption of goods B,C,...,Z. Consider how the total utility of a commodity set changes depending on the volume of consumption of the commodity A(e.g. apples). At the top of Fig. 3.1a shows this dependence. Cut length OK is equal to the utility of the product set with the volumes of goods fixed by us B, C,..., Z and at zero volume of consumption of goods A. In quantity theory, it is assumed that the function TU at the top of Fig. 3.1, but increasing (the more apples, the greater the utility of the commodity bundle) and convex upwards (each subsequent apple increases the total utility of the commodity bundle by a smaller amount than the previous one). In principle, this function can have a maximum point ( S), after which it becomes decreasing (imagine that you are forced to consume 100 kg of apples every month).

At the bottom of Fig. 3.1, a shows the dependence of the marginal utility of apples on the volume of their consumption.

marginal utility≈ it overall utility gain goods set when the volume of consumption of this product increases by one unit.

Mathematically, the marginal utility of a good is the partial derivative of the total utility of a set of goods (3.1) with respect to the volume of consumption of the i-th good:

Geometrically, the value of marginal utility (the length of the segment ON) is equal to the tangent of the slope of the tangent to the curve TU at the point L. Because the line TU convex upwards, with an increase in the volume of consumption of the i-th product, the slope of this tangent decreases and, consequently, the marginal utility of the product also decreases. If at a certain volume of its consumption (in our figure Q▓" A) the total utility function reaches its maximum, then at the same time the marginal utility of the good becomes zero.

The principle of diminishing marginal utility is often called Gossen's first law, named after the German economist G. Gossen (1810-1859), who first formulated it in 1854. 4 This law contains two provisions. The first states the decrease in the utility of subsequent units of a good in one continuous act of consumption, so that, in the limit, full saturation with this good is achieved. The second states the decrease in the utility of the first units of the good during repeated acts of consumption.

The principle of diminishing marginal utility is essentially similar to the so-called basic psychophysical law of Weber-Fechner, 5 which characterizes the relationship between the strength of the stimulus (stimulus) and the intensity of sensation. According to this law, stimuli of equal intensity, repeated for a certain time, are accompanied by a decrease in the intensity of sensations.

The principle of diminishing marginal utility is that as the consumption of one good increases (while the volume of consumption of all the others remains unchanged), the total utility received by the consumer increases, but increases more and more slowly. Mathematically, this means that the first derivative of the total utility function with respect to the amount of a given good is positive, and the second is ≈ negative:

However, the principle of diminishing marginal utility is by no means universal. In many cases, the marginal utility of subsequent units of a good first increases, reaches a maximum, and only then begins to decrease. This dependence is typical for small portions of divisible goods. The second puff of a cigarette smoked in the morning is perhaps more useful for the amateur than the first, and the third more than the second.

Such a situation is shown in Fig. 3.1.6. In the range from zero to Q" A total utility increases faster than the amount of consumption of a good increases, and marginal utility also increases. In the range from Q" A before Q▓" A total utility grows more slowly than consumption, while marginal utility decreases from the maximum level (at the point L") to zero. Mathematically, this means that in the area from zero to Q" A both the first and second partial derivatives of the total utility function with respect to the volume of consumption of this good are positive:

Thus, the principle of diminishing marginal utility, or Gossen's first law, is valid only if the second partial derivative of the total utility function is negative. However, since the consumer buys on the market not individual acts of consumption (in our example, ≈puffs), but certain goods (in our example, cigarettes), we can assume that Gossen's first law (3.3) is satisfied for goods circulating on the market.

Suppose now that the consumer has some income; commodity prices A, B, ..., Z do not depend on its behavior and are equal, respectively P A , P B , ┘,P Z there is no commodity shortage; all commodities are infinitely divisible (such as sausage, butter, etc.).

Under these assumptions, the consumer will achieve maximum satisfaction if he allocates his funds to the purchase of various goods in such a way that:

1) for everyone is real purchased them goods A, B, C,... takes place

where MU A , MU B , MU C≈ marginal utilities of goods A, B, C; l ≈ some value characterizing the marginal utility of money; 6

2) for everyone non-buyable them goods Y, Z,... takes place

Let us prove the first part of the assertion.

Assume the opposite: goods A and V actually bought by the consumer, but MU A /P A > MU B /P B. For definiteness, suppose that MU A= 40 utils per kilogram, P A= 2 rub. per kilogram MU B= 20 utils per kilogram, P B= 4 rubles. per kilogram. As a result

(MU A/P A= 40 utils / 2 rubles) > (20 utils / 4 rubles = MU B/P B

It is obvious that the buyer thus does not reach a maximum of satisfaction. It can reduce the consumption of goods V per 1 kg, while he will lose 20 utils. But due to the saved 4 rubles. he can buy extra 2kg of goods A and receive an additional approximately 80 utils. (The word "about" is used here because the 2nd additional kilogram of the good A may bring less utility than 1st, say only 39 utils, not 40). The net winnings will be approximately 80 - 20 = 60 utils. As the consumption of good B decreases, its marginal utility decreases. Therefore the difference between MU A/P A and MU B/P B will be reduced. The redistribution of costs will occur until the ratio of marginal utility to price for each actually purchased product becomes the same.

Equality (3.4) can be interpreted as follows. Attitude MU A/P A represents the increase in total utility as a result of an increase in consumer spending on a product A for 1 rub. Obviously, in the consumer's optimum state, all such ratios for actually purchased goods must be equal to each other. And any of them can be considered as marginal utility of money(more precisely, 1 rub.). Value A shows how many utils the total utility increases with an increase in consumer income by 1 rub.

The second part of the assertion can be proved in a completely analogous way, by contradiction. The meaning of formula (3.5) is that if the 1st ruble spent on the purchase of goods Z brings to the consumer insufficiently high utility, then he generally refuses to consume this product.

Thus, equality (3.4) shows that at the optimum (maximum utility for given consumer tastes, prices, and incomes), the utility derived from latest of the monetary unit spent on the purchase of any product is the same, regardless of which product it is spent on. This position is called Gossen's second law. Of course, the consumer may repent of a purchase even if it satisfies equality (3.4). This will mean that "during the time from purchase to repentance" the sign in (3.4) for this product has changed to the opposite. 7

Let us now try to show, on the basis of a quantitative approach, that the quantity demanded and the price are inversely related. Consider again equality (3.4).

Assume that the price of a product purchased by the consumer A rose. As a result, the first ratio in equality (3.4) has decreased. To restore equality (3.4) and maximize total utility, the consumer will begin to reduce consumption of the good A. Other consumers will do the same. Thus, as the price of a commodity increases, the demand for it decreases. eight

production costs in the short run.

The production of goods and services is carried out not only in space, but also in time. A. Marshall first drew attention to this and singled out two periods in the production process: long-term and short-term.

The long-term period is a period of time sufficient to change the amount of all factors of production (both labor and capital).

Short-term is a period of time insufficient for such changes. The short-term period of production is such a period of time during which several (or at least one) of the factors of production are constant, while the other (or at least one) factors are variable.

In the short run, the amount of labor changes, while the amount of capital remains unchanged. Thus, in the short run, there are both fixed and variable factors of production.

Fixed costs - (FC) - the costs that the company incurs regardless of the volume of output. They also exist at zero output. So, for example, if an entrepreneur has entered into a lease agreement for a premises for a period of one year, then he is obliged to pay rent in any case: when he produces 100 units of products, and when he produces 1000 units of products, and when he stops production altogether. Therefore, graphically, fixed costs are presented as a horizontal line, which means that the value of these costs remains constant with a change in the volume of output (Fig. 2, Table 3.4).

Figure 2 - Fixed costs of the firm

Fixed costs include:

- rent for the use of premises;

- · depreciation deductions;

- rent payments;

- Salary to higher management staff;

- payment of obligations of the enterprise on bonds.

Variable costs - VC costs, the value of which changes with a change in the volume of output (Fig. 3). Since in the short run some of the factors of production remain constant, it is possible to increase the volume of production by increasing the number of variable factors used. Attracting additional volume of variable factors of production means an increase in the variable costs of the enterprise (remember that costs depend on the prices of factors of production and on the number of factors used). Therefore, the greater the output, the higher the value of variable costs, all other things being equal. With zero output, variable costs are zero, since when the enterprise ceases to operate, the entrepreneur will not buy raw materials or hire workers.

Variable costs include:

- Costs of raw materials, components, auxiliary materials;

- on the wages of key employees;

- fuel, energy for technological needs, etc.

General (cumulative, gross) costs TC are equal to the sum of all fixed and variable costs:

Figure 3 - General, fixed, variable costs

Marginal cost (MC) is the change in the firm's total cost as a result of producing one additional unit of output (or the incremental cost associated with producing one more unit of output). The economic meaning of marginal cost is that it shows the entrepreneur what it will cost the firm to increase output by one unit.

Since fixed costs do not change with a change in the firm's output, marginal cost is only determined by the increase in variable costs resulting from the production of an additional unit of output. Therefore, marginal costs can also be calculated using formulas 4 and 5:

where - change in the value of gross costs;

Change in the value of variable costs;

Change in the volume of output.

Figure 4 - Average and marginal costs

As can be seen from the graph, initially marginal cost may decrease with increasing production, although a decrease in marginal cost is not necessary in all cases. However, at some point, marginal cost begins to rise as output increases. The increase in marginal cost is the most common case, and it is associated with the operation of the law of diminishing marginal productivity of the variable factor of production.

There is an inverse relationship between marginal productivity and marginal cost: the lower the marginal product, the greater the marginal cost, and vice versa. Hence, when marginal productivity increases, MC decreases; when marginal product decreases, MC increases.

Average cost is the cost per unit of output.

products. Average costs show how much it costs a firm to produce one unit of output on average. In real domestic practice, this is called the unit cost of production.

There are average fixed, average variable and average gross production costs.

Average fixed costs (AFC) are the quotient of fixed costs (FC) divided by the volume of output:

where FC is fixed costs;

Q is the volume of production.

Average variable cost (AVC) is the quotient of variable cost (VC) divided by the volume of output:

where VC - variable costs;

Q - production volume

As can be seen from Figure 3.3, the average variable cost curve has a horseshoe shape: first, with an increase in output, average variable costs decrease, and then begin to increase. Such dynamics of average variable costs is explained by the fact that they ultimately depend on the magnitude of marginal costs.

Knowing the curves of average fixed and average variable costs, it is easy to construct a curve of average total costs, since the latter is nothing more than the sum of average fixed and average variable costs. Indeed, if

ATC= AFC+ AVC (.8)

Average costs form the basis for the development of economic models for the behavior of firms in various markets.

Costs(cost) - the cost of producing goods and services during certain period time.

Costs- calculated value. The choice of resources for the production of any product means the impossibility of using these resources to create some other, alternative product (service). The costs of the firm are divided into external and internal.

External costs(external costs) - out-of-pocket expenditures incurred by the firm for the acquisition of human and material factors of production, or "hired" resources. They are regarded as explicit costs, since it is the cost of the firm to acquire the necessary resources from an external supplier.

Internal (implicit, hidden) costs(implicit costs) - is the cost to the firm of using its own resources. They are considered as imputed (opportunity) costs.

For example, the use of the labor of the owner of this firm by another manufacturer as a manager of the company. The salary he will receive elsewhere is imputed (opportunity) costs.

Accounting costs equal to external costs.

Economic (general) costs- the sum of external and internal costs, or explicit and implicit (opportunity) costs.

Taking into account not only explicit, but also opportunity costs, allows a more accurate assessment of the economic profit of the company.

economic profit- the difference between gross income and costs (explicit and alternative).

Production costs in the short run

short term - this period of time is too short for the firm to change its fixed resources, or production capacity.

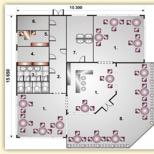

Types of costs in the short term are shown in Fig. 7.1.

Rice. 7.1.

Production costs in the short run depend not only on prices, but also on the amount of resources consumed, since in the short run a firm can change the volume of production by combining a changing amount of resources with fixed production capacities. In this regard, production costs in the short run are divided into fixed, variable, general, average and marginal.

fixed costs(fixed cost, FC) - costs that do not depend on the volume of production. They will always take place, even if the company does not produce anything. These include: rent, depreciation of buildings and equipment, insurance premiums, expenses for overhaul, payment of obligations under bonded loans, salaries of senior management personnel, etc. Fixed costs remain the same at all levels

production, including zero. Graphically, they can be represented as a straight line parallel to the x-axis (Fig. 7.2). It is indicated by a straight line / - "C.

Rice. 7.2.

variable costs (variable cost, VC) - costs that depend on the volume of production. These include the costs of wages, raw materials, fuel, electricity, transport services, etc. Unlike fixed costs, variable costs vary in direct proportion to the volume of production. Graphically, they are depicted as an ascending curve (see Fig. 7.2), denoted by the line VC.

The variable cost curve shows that as output increases, the variable costs of production increase.

The distinction between fixed and variable costs is essential for every businessman. An entrepreneur can manage variable costs, as their value changes over a short period as a result of changes in the volume of production. Fixed costs are beyond the control of the company's administration, since they are mandatory and must be paid regardless of the volume of production.

General, or gross, costs (total cost, TC) - overall costs for a given volume of production. If we superimpose the curves of fixed and variable costs on top of each other, we get a new curve that reflects the total costs (see Fig. 7.2). It is marked with a curve TS. In this way, TC=FC+VC.

V economic analysis In addition to average total costs, concepts such as average fixed and average variable costs are used. They are calculated as follows: average fixed costs (A.F.C.) equal to the ratio of fixed costs (FC) to production (Q): AFC=FC/Q. Average variable costs (AVC) by analogy, are equal to the ratio of variable costs (VC) to product release: AVC=VC/Q.

Average total cost (average total cost, ATS, sometimes AC) equal to the ratio of the sum of average fixed and variable costs to output:

The value of average fixed costs continuously decreases as the volume of production increases, since the fixed amount of costs is distributed over more and more units of production. Average variable costs change in accordance with the law of diminishing returns.

Average total costs are usually used to compare with the price, which is always quoted per unit. Such a comparison makes it possible to determine the amount of profit, which allows you to outline the tactics and strategy of the company in the near future and in the future. We get the graph of average total costs by summing the graphs of average fixed and average variable costs.

Graphically, the curve of average total (gross) costs is represented by the curve ATS(Fig. 7.3).

Rice. 7.3.

Figure 7.3 shows that the average cost curve is ^-shaped. This suggests that average costs may or may not be equal to the market price. A firm is profitable or profitable if the market price is above average cost.

The most efficient output will be the one that meets minimum size average total costs, i.e. per unit of output will account for the minimum amount of costs for its production. In the figure, the situation of production efficiency is indicated by a black dot. This point (minimum average total cost) characterizes the most efficient amount of output.

Efficiency- a characteristic of the ratio of the volume of goods produced and the costs of their production.

Marginal cost is important for determining the firm's strategy in economic analysis.

Marginal or marginal cost (marginal cost, MS) - is the cost of producing an additional unit of output.

MS can be determined for each additional unit of output by dividing the change in the increase in the sum of the total costs (dTC) on the value of the increase in output (dQ):

![]()

Marginal cost measures how much it will cost a firm to increase its output by one unit. Graphically, the marginal cost curve is an ascending line MS, intersecting with the average total cost curve ATS and the average variable cost curve A US(Fig. 7.4).

The marginal cost curve intersects the average variable and average total cost curves at their minimum points. After these points, these costs begin to increase, and the costs of factors of production increase. Comparing average variables and marginal production costs is important information for managing a firm, determining optimal sizes production, within which the company consistently receives income.

Cost analysis is carried out with the obligatory differentiation of the period into short-term and long-term. The essence of the differences between them lies in the increase in production capacity. In a short time it is impossible to technically re-equip the enterprise, reconstructions are carried out for quite a long time. Calculating production costs in long term and by establishing their dynamics, the economist will be able to determine the firm's strategic paths for maximizing profits and minimizing costs. But first you need to decide on such an economic concept as production costs in the short run.

Production costs in the short run

Production costs of short periods are characterized by division into fixed and variable. The former do not depend on the size of production, and the enterprise carries them even when work stops. Usually these are rent, depreciation, planned overhaul costs, A&M salary, etc. The variables change due to changes in production volumes. This is the salary of shop personnel, the cost of material and energy resources, the transportation of finished goods.

The distinction between cost elements is important for any business because variable costs can be managed. Permanent ones are not controlled by the administration of the company - they are mandatory in any situation. The combination of fixed and variable costs creates a gross or total figure.

The dynamics of production costs in the short term can be traced in a graph that clearly demonstrates the growth of production costs due to variable costs with an increase in output:

For a detailed cost analysis, in addition to the average total costs, average fixed and average variable costs are used, calculating them as the ratio of the size of the corresponding costs to the output. This is how production costs are determined in the short run. Let's briefly explain what short run cost analysis shows:

- with an increase in production volumes, the size of average fixed costs gradually decreases, since a constant amount of costs is distributed over an increasing number of units produced;

- average variable costs vary according to the law of diminishing returns.

Average total cost is usually needed by an economist to analyze the comparison with the price of a manufactured product. This makes it possible to calculate the amount of profit and determine the ways of the company's development in the near future.

Production costs in the long run

The production costs in the short and long run are homogeneous in composition, but the costs in the long run differ in specifics, since they are interconnected with the scale of production, which can change radically. Here, the main feature of costs is that they are all variable, since all resources can change. For example, a company can increase or reduce capacity, move to another industry, etc. Therefore, the company's production costs in the long run are not divided into average constants and average variables, and analysts work with long-term average total cost essentially being average variable costs.

Economists often resort to dividing the long run into many short runs and analyze the dynamics of production costs in the long run by combining short run cost analysis data. This method enables the economist to fix the lowest cost per unit of output for any output and determine the necessary factors of production that can be changed. Graphically it looks like this:

Production costs in the long run: economies of scale

The development of production affects costs in different ways. The cost savings associated with capacity growth and the increased returns from capacity growth due to higher output of goods create a positive effect, since average long-term costs per unit of output in such conditions are markedly reduced.

However, the positive effect of the increasing scale of production is not unlimited. Over time, the expansion of the company can cause negative results if the increase in output leads to an increase in costs. This happens, for example, with a decrease in consumer demand and a decrease in sales opportunities. The negative effect is characterized by a decrease in the efficiency of the company and an increase in average costs, so the company, when planning the scale of production, should limit the limits of its expansion. Constant returns to scale arise when costs and output are equal in terms of growth rate.

We have explained what the costs of production in the long run represent in economics briefly, but , understanding their structure and dynamics, it is easy to explain the importance of these indicators in determining the company's strategy for optimizing production and making a profit.