Computer simulation refers to qualitative forecasting methods. Quantitative and qualitative methods of forecasting in the practice of making managerial decisions. brainstorming method

Qualitative forecasting methods

Analyzing the activities of the enterprise, making a forecast of its functioning, the analyst does not always have information sufficient to quantitative methods forecasting, and sometimes the top management of the company simply does not understand the complex methods of quantitative forecasting, which, in any case, requires the use of qualitative forecasting methods.

Qualitative forecasting methods involve referring to the opinion of experts, people who are the most competent on the issues under study.

Qualitative forecasting methods include the following: The opinion of the jury, as a rule, comes down to a generalization of the opinions of experts with their further averaging; Needs expectation model method, which is to some extent the opposite of the aggregate opinion method, a survey of customers is carried out; Peer Review Method Selected and trusted experts complete a questionnaire.

Of the totality of possible methods of analysis, probably one of the most promising is the scoring method. It can be used not only for forecasting, but also for planning and analysis. This method allows you to objectify the totality of subjective opinions.

For the first time, the scoring method was developed and used by US analysts to assess the defense power of the Soviet Union.

Currently, the scoring method is widely used in solving many problems of planning and forecasting in conditions of limited initial data, for example, determining options solving a managerial problem with a quantitative calculation of the preference of each of the options, a quantitative assessment of the degree of influence of various factors on the analyzed object, and many others.

In each case, the stages and sequence of their implementation have their own specifics, however, there is a general methodology for the scoring method, which in a formalized version can be represented as follows: formulating the purpose of the expert analysis; determination of a group of specialists providing for the examination; development and maintenance of expert analysis; formation of a group of experts participating in the examination; development of a questionnaire with the formulation of questions that exclude their double interpretation and are focused on quantitative assessment; conducting a survey; analysis of questionnaires; conducting a survey for the second, third, fourth time, depending on the complexity of the study and the required accuracy; generalization of results.

Basically, the execution of almost all stages is of a technical nature. The results obtained can be used to make management decisions. It should be noted once again that the method of expert assessments is universal and suitable for solving various problems.

Reserves play an important role in strategic planning under conditions of uncertainty:

1. Insurance within the company availability of stocks of raw materials, free capacities, Money, contacts and connections. The basis of this approach to reserves is finance.

2. Access to credit development of financial policy, asset and liability management.

Stages of development of the intrafirm plan.

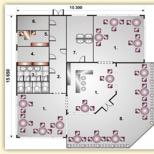

Process strategic planning consists of seven interrelated stages; carried out jointly by the management of the company and employees of marketing services.

source unknown

As mentioned above, in order to use quantitative forecasting methods, it is necessary to have sufficient information to identify a trend or a statistically significant relationship between variables. When the amount of information is insufficient, or management does not understand a complex method, or when a quantitative model becomes prohibitively expensive, management may resort to qualitative forecasting models. At the same time, forecasting the future is carried out by experts who are asked for help. The four most common qualitative forecasting methods are the jury opinion, the aggregate opinion of the marketers, the consumer expectation model, and the expert judgment method.

JURY OPINION. This forecasting method consists in combining and averaging the opinions of experts in relevant fields. For example, in order to predict the profitability of producing a new model of computer, Control Data can provide its production, marketing, and finance managers with basic information and ask them for their opinion on possible sales and its limits. An informal variation of this method is brainstorming, during which the participants first try to generate as many ideas as possible. Only after the generation process is stopped are some ideas evaluated. This can be time consuming, but often rewarding, especially when the organization needs a lot of new ideas and alternatives.

UNITED OPINION OF THE SALES OFFICERS. Experienced salespeople are often excellent at predicting future demand. They are intimately familiar with consumers and can take into account their recent actions faster than a quantitative model can be built. In addition, good trading agent at a certain time interval, the market often “feels” in fact more accurately than quantitative models.

CONSUMER EXPECTATION MODEL. As the name suggests, the consumer expectation model is a prediction based on the results of a survey of an organization's customers. They are asked to evaluate their own future needs as well as new requirements. By collecting all the data obtained in this way and adjusting for over- or underestimation based on their own experience, the manager is often able to accurately predict aggregate demand.

METHOD OF EXPERT ASSESSMENTS. It is a more formalized version of the collective opinion method. Initially, the method was developed by the Rand Corporation to predict events of interest to the military. Peer review is, in principle, a procedure that allows a group of experts to come to an agreement. Experts from a wide range of but related fields fill out a detailed questionnaire about the issue at hand. They also write down their opinions about it. Each expert then receives a summary of the other experts' answers and is asked to re-examine their prediction, and if it does not match the others' predictions, they are asked to explain why. The procedure is usually repeated three or four times until the experts reach a consensus.

The anonymity of experts is very important point. It helps to avoid possible group reflection on the problem, as well as the emergence of interpersonal conflicts based on differences in status or social coloring of expert opinions. Despite some doubts about reliability, since the result obviously depends on which experts are consulted, the method of expert judgment has been successfully used for forecasting in the most different areas- from the expected sales of products to changes in complex structures such as social relations and latest technology. The method was used to assess the future military capabilities of the USSR, state policy in the field of scientific and technological progress, and to measure the quality of life in America.

Summary

1. Methods of management science improve the quality of decisions made through the use of a scientific approach, system orientation and models.

2. A model is a representation of a system, idea, or object. The manager often has to use models because of the complexity of organizations, the inability to conduct experiments in the real world, the need to look into the future. The main types of management science models are physical, analog, and mathematical or symbolic.

3. The stages of building a model are as follows: setting the problem, determining information constraints, checking for validity, implementing conclusions, and updating the model.

4. Common modeling problems are invalid assumptions, information limitations, poor use of results, and excessive costs.

5. Game theory is a method used to evaluate the impact of an action on competitors. Models of queuing theory can be used in accordance with the demand for them. Inventory management models help the manager synchronize the placement of orders for resources and optimize their volumes, as well as determine the optimal quantity for the warehouse finished products. Linear programming models allow us to establish the optimal way to allocate scarce resources among competing needs for them. Simulation is the use of a device that mimics the real world. V economic analysis a number of methods are used to determine economic situation organization or the feasibility of an action from an economic point of view.

6. The payoff matrix method is useful when it is required to establish which alternative is most likely to contribute to the achievement of goals. The expected value of the consequences (the sum of the possible values multiplied by their probabilities) must be determined before the payoff matrix can be compiled.

7. The decision tree allows you to represent the problem schematically and compare possible alternatives visually. This method can be used for difficult situations when the result of the decision made affects the subsequent ones.

8. Forecasting is used to identify alternatives and their probabilities. Quantitative forecasting methods include time series analysis and causal modeling. Qualitative methods are understood as the opinions of the jury, the aggregate opinion of marketers and the method of expert assessments.

REVIEW QUESTIONS

1. What are the three distinguishing features of the management science approach to problem solving?

2. Discuss the three types of models: physical, analog, and mathematical.

3. Describe the steps in the model building process.

4. Discuss the following model building issues: information limitations, user fear, poor utilization of results, and high cost.

5. Briefly describe the management science models discussed in the chapter.

6. Consider the following decision methods: break-even analysis, payoff matrix method, expected value method, and decision tree method.

7. What is forecasting?

8. Consider two typical quantitative forecasting methods: time series analysis and causal modeling.

9. Consider four widely used qualitative forecasting methods: jury opinion, marketers' aggregate opinion, consumer expectation method, and expert judgment method.

10. How can a manager make useful forecasts in a business environment?

ISSUES FOR DISCUSSION

1. Bring together the various model definitions presented in the chapter and come up with your own definition.

2. Compare quantitative and qualitative forecasting methods.

3. David B. Hertz says, "The manager must find ways to choose between alternatives to allocate his resources, determine the sequence of actions for himself and others, and to attract new specialists of different profiles and material resources." How can a modern leader deal with these problems?

4. Consider the various technical components and human factors that the manager must keep in mind when developing the model.

5. How can a manager overcome the many challenges that naturally arise when building a model?

Analyzing the activity of the enterprise, making a forecast of its functioning, the analyst does not always have information sufficient for quantitative forecasting methods, and sometimes the top management of the company simply does not understand the complex methods of quantitative forecasting, which, in any case, requires the use of qualitative forecasting methods.Qualitative forecasting methods involve appealing to the opinion of experts - people who are the most competent on the issues under study.

Qualitative forecasting methods include the following:

The opinion of the jury, as a rule, comes down to a generalization of the opinions of experts with their further averaging;

Needs expectation model - a method that is to a certain extent the opposite of the aggregate opinion method, a survey of customers is carried out;

Method of expert assessments - selected and trusted experts fill out a questionnaire.

Of the totality of possible methods of analysis, probably one of the most promising is the scoring method. It can be used not only for forecasting, but also for planning and analysis. This method allows you to objectify the totality of subjective opinions.

For the first time, the scoring method was developed and used by US analysts to assess the defense power of the Soviet Union.

Currently, the scoring method is widely used in solving many problems of planning and forecasting in conditions of limited initial data, for example, determining possible options for solving a management problem with a quantitative calculation of the preference of each option, quantifying the degree of influence of various factors on the analyzed object, and many others.

In each case, the stages and sequence of their implementation have their own specifics, however, there is a general methodology for the scoring method, which in a formalized version can be represented as follows:

Formulating the purpose of the expert analysis;

Determination of a group of specialists providing for the examination;

Development and provision of expert analysis;

Formation of a group of experts participating in the examination;

Development of a questionnaire with the formulation of questions that exclude their double interpretation and are focused on quantitative assessment;

Conducting a survey;

Analysis of questionnaires;

Conducting a survey for the second, third, fourth time, depending on the complexity of the study and the required accuracy;

Generalization of results.

Basically, the execution of almost all stages is of a technical nature. The results obtained can be used to make managerial decisions. It should be noted once again that the method of expert assessments is universal and suitable for solving various problems.

Reserves play an important role in strategic planning under conditions of uncertainty:

1. Insurance within the company - the availability of stocks of raw materials, free capacity, cash, contacts and connections. The basis of this approach to reserves is finance.

2. Access to credit - development of financial policy, asset and liability management.

Stages of development of the intrafirm plan.

The strategic planning process consists of seven interrelated steps; carried out jointly by the management of the company and employees of marketing services.

Let us consider in more detail the main forecasting methods used in the process of evaluating the sales market, the results of which are reflected in this section of the business plan.

quality methods. Based on the study of existing experience, knowledge and intuition of the researcher. The most widespread in this group are the methods of expert assessments. The essence of the method is that predictive estimates are determined on the basis of expert opinions, who are entrusted with a reasoned justification of their opinion on the state and development of a particular market or problem. Methods of expert assessments, as a rule, are of a qualitative nature.

For market forecasting, expert assessment methods can be used to:

- 1) development of medium and long-term demand forecasts;

- 2) short-term demand forecasting for a wide range of products;

- 3) assessment of emerging demand for new products;

- 4) determining consumer attitudes towards new products and possible demand for them;

- 5) evaluation of competition in the market;

- 6) determining the position of the company in the market, etc. Less commonly, expert methods are used to predict the market capacity and sales volumes of the company.

The advantages of expert methods are their relative simplicity and applicability in forecasting almost any situation, including in conditions of incomplete information. An important feature of these methods is the ability to predict quality characteristics market, for example, a change in the socio-political situation in the market or the impact of the environment on the production and consumption of certain goods.

The disadvantages of expert methods include the subjectivity of expert opinions, the limitations of their judgments.

Expert assessments are divided into individual and collective.

to individual expert opinion include:

- 1) interview method;

- 2) analytical reports;

- 3) scenarios.

The interview method involves a conversation between the organizer of forecasting activities and an expert forecaster, in which questions are raised about the future development of the market, the state of the company and its environment.

The method of analytical memorandums means the independent work of an expert on the analysis of the business situation and possible ways of its development.

The scripting method has gained wide popularity in recent decades.

A scenario is a description (picture) of the future, based on plausible assumptions. As a rule, the situation forecast is characterized by the existence of a certain number of probable development options. Therefore, the forecast usually includes several scenarios. In most cases, these are three scenarios - optimistic, pessimistic and medium, that is, the most likely, expected.

Qualitative (expert) forecasting methods are used in the following cases:

The extreme complexity of the system,

system novelties,

Uncertainties in the formation of some essential features,

Insufficient completeness of information

The impossibility of a complete mathematical formalization of the process of solving the problem of forecasting.

According to the principle of action expert methods are divided into:

Individual expert assessments,

Collective expert assessments.

To an individual expert assessment include: interview method, analytical individual assessment method, scenario method, etc.

Interview method based on a conversation between an expert and a forecaster according to the “question-answer” scheme.

At analytical individual assessment the expert analyzes the set of reliable and diverse information provided to him on the problem under study.

Scenario- this is a model of the future, which describes the possible course of events, indicating the probability of the scenario.

Figure - Scenario building model

Stages of scripting:

Structuring and wording of the question.

Definition and grouping of spheres of influence.

Setting indicators for future development is critical important factors DS.

Formation and selection of consistent sets of assumptions.

Comparison of the planned indicators of the future state of spheres of influence with assumptions about their development.

Introduction to disruptive event analysis

Establishing consequences.

Taking action.

Method of collective expert survey - e then a forecasting method based on the identification of a generalized objective assessment by an expert group by processing individual independent assessments made by experts in the group:

brainstorming method.

Delphi method.

Market research method is the most complex of the qualitative methods. Market researchers obtain information through mail surveys, group and individual interviews. The collected data is then subjected to various statistical processing in order to test market hypotheses.

Local forecasts- individual forecasts from the field, they can be given by people who are closest to the problem (sellers). These forecasts are then aggregated to produce a comprehensive (sales) forecast;

Method of historical analogy or derived forecasts.

Table. Qualitative forecasting methods

|

Delphi method |

Market research |

group consent |

Local forecast |

Historical analogy |

|

|

Accuracy* short medium term long-term | |||||

|

Price | |||||

|

Preparation time |

* 5 - excellent, 4 - good, 3 - average, 2 - unsatisfactory, 1 - poor.

Topic. Analytical methods of time series

A series of values taken over a time period is called time series .

Statistical research methods are based on the assumption that it is possible to represent the values of the time series as the sum of several components, reflecting the regularity and randomness of development:

Y(t) = T(t) + S(t) +WITH(t) + I(t),

where Y(t) is the value of the time series at time t.

T(t)- trend (long-term trend) of development. Shows the general type of change in historical data.

S(t) is the seasonal component. These are fluctuations around a trend that occur on a regular basis. Typically, such regular fluctuations occur in periods of up to one year.

С(t) is the cyclic component. These fluctuations occur in periods longer than one year. They are often present in financial data following the standard business cycle of boom, bust, boom, and stagnation.

I(t) is an irregular component. These are unpredictable random fluctuations present in most real time series.

Initial data requirements:

Comparability is achieved as a result of the same approach to observations at different stages of the formation of the time series. The levels in the time series must be expressed in the same units of measurement, have the same observation step, be calculated for the same time interval, using the same methodology, cover the same elements belonging to the same territory belonging to the same population .

representativeness data is characterized primarily by their completeness. A sufficient number of observations is determined depending on the purpose of the study.

Uniformity, i.e. the absence of atypical, anomalous observations, as well as breaks in trends.

Sustainability. The stability property reflects the predominance of regularity over randomness in changing the levels of the series.

Indicators of the dynamics of changes in the levels of the time series:

|

Indicator |

Formula |

|

Absolute growth base |

APB(t) = Y(t) - Y(1) |

|

Absolute increase chain |

APC(t) = Y(t) - Y(t-1) |

|

Base growth rate |

BKR(t) = Y(t) / Y(1) |

|

Chain growth factor |

CKR(t) = Y(t) / Y(t-1) |

|

Basic growth rate |

BKP(t) = (Y(t) - Y(1)) / Y(1) |

|

Growth rate |

TR(t) = CKR100% |

|

Growth rate |

TP(t) = TP(t) - 100% |

|

Average growth rate |

STR =(Y(N)/Y(1)) 1 / (N-1)* 100 |

|

Average growth rate |

STP = STR - 100% |

|

Average absolute growth |

SAP = (Y(N) - Y(1)) / (N-1) |

Formation of a set of forecasting models

1 For description processes without growth limit serve functions:

|

Y(t) = A 0 + A 1 t | |

|

Y(t) = A 0 + A 1 t+A 2 t 2 |

Parabola II order |

|

Y(t) = exp(A 0 )t A1 |

- power |

|

Y(t) = exp(A 0 + A 1 t) |

- exhibitor |

|

Y(t) = exp(A 0 + A 1 t)t A2 |

Kinetic curve |

|

Y(t) = A 0 + A 1 Lnt (1+ A 2 lnt) |

- linear-logarithmic function of the second order |

|

Y(t) = A 0 + A 1 Ln(t) |

- linear-logarithmic function of the first order |

Development processes of this type are characteristic mainly of absolute volumetric indicators, but they often correspond to the development of certain qualitative relative indicators.

2 For description processes with growth limit serve functions:

|

Y(t) = exp(A 0 + A 1 / t) |

johnson curve |

|

Y(t) = A 0 + t / (t + A 1 ) |

The second Tornquist function |

|

Y(t) = A 0 - A 1 exp (- t) |

Modified exhibitor |

Processes with a growth limit are characteristic of many relative indicators (per capita food consumption, fertilizer application per unit area, costs per ruble of output, etc.).

3 To describe processes of the third type - with growth limit and inflection point the kinetic curve (Pearl-Read curve) and the Gompertz curve are used:

Y(t) = exp(A 0 - A 1 exp(t)).

This type of development is characteristic of the demand for some new products.

Model parameters can be meaningfully interpreted. Yes, the parameter A 0 in all models without a growth limit, it sets the initial conditions for development, and in models with a growth limit, it sets the asymptote of functions, the parameter A 1 determines the speed or intensity of development, parameter A 2 - change in the speed or intensity of development.

Smoothing methods:

moving average models.

This method assumes that the next indicator in time is equal in value to the average calculated value, as a rule, for the last 3 months.

Example: total sales amounted to 270 units in March, 260 in April, and 290 in May. The sales forecast for July is equal to the moving average and is equal to (270+260+290)/3=273.

If the real sales figure for June was 280, then the sales forecast for July is (260+290+280)/3=277

Exponential smoothing method.

This method is a forecast of an indicator for a given period and a forecast for a given period as the sum of the actual indicator for a given period and a forecast for a given period, weighted using special coefficients.

where Ft+1 is the sales forecast for the month t+1,

Xt – sales in month t (actual data)

Ft – sales forecast for the month

- special correction factor (usually 0.3)

Using the exponential smoothing formula, you can calculate the sales forecast, provided that the actual sales data are known.

Example: sales in January were 50 units, while the forecast for January was 65 units.

0,3*50+0,7*65=61

Trend projection - selection of a straight line to the existing time series in such a way that the scatter of observations on both sides of it would be the smallest, and extrapolation of the resulting line to the required depth of the forecast horizon.

Decomposition of time series - selection of the seasonal component from the multiplicative model.

Mixed models of the integrated moving average). Models of the latter class are usually implemented using the Box-Jenkins technique. They, like many other tools of statistical analysis that are complex from a theoretical and practical point of view, require an individual approach to the indicator under study and high qualification of the researcher. The Box-Jenkins method (ARIMA) differs from most methods because it does not assume any particular structure in the time series data being forecasted. It uses an iterative approach to determine a valid model among general class models. The selected model is then compared with historical data to check if it accurately describes the series. If the given model is not satisfactory, the process is repeated, but using a new, improved model.